Congress is once again facing the age-old dilemma of either raising the arbitrary limit on our borrowing or tanking the economy and causing irreparable harm to the dollar’s position as the reserve currency of the world.

This isn’t a piece about the debt ceiling because, God willing, Congress will do its duty and ensure we pay our bills. Estimates from Goldman Sachs project that one-tenth of economic activity would halt if the debt ceiling is breached, and the think tank Third Way projects that 3 million jobs could be wiped out if we default. These are absolutely unacceptable consequences, and negotiating over the debt ceiling should be strictly off-limits. Nevertheless, House Republicans seem set on making it a cudgel in a conversation about the national debt.

I don’t have much sympathy for House Republicans suddenly remembering that they are supposed to be fiscal hawks. As Democrats keep pointing out, the national debt exploded during Trump’s presidency, aided by loose pandemic spending and tax cuts which certainly did not pay for themselves. Biden largely kept the party going in his first two years in office, adding trillions to the debt through more pandemic stimulus, the bipartisan infrastructure law, and student loan relief which itself could increase the debt by $750 billion over the next decade.

So while Congress shouldn’t be arguing over who caused the debt, a conversation about addressing it is overdue. As dozens of wealthy countries who have faced debt-related crises demonstrate, national debts are very easy to ignore until they aren’t. When that happens, the effects on democracy can be seismic.

US Debt is Unsustainable

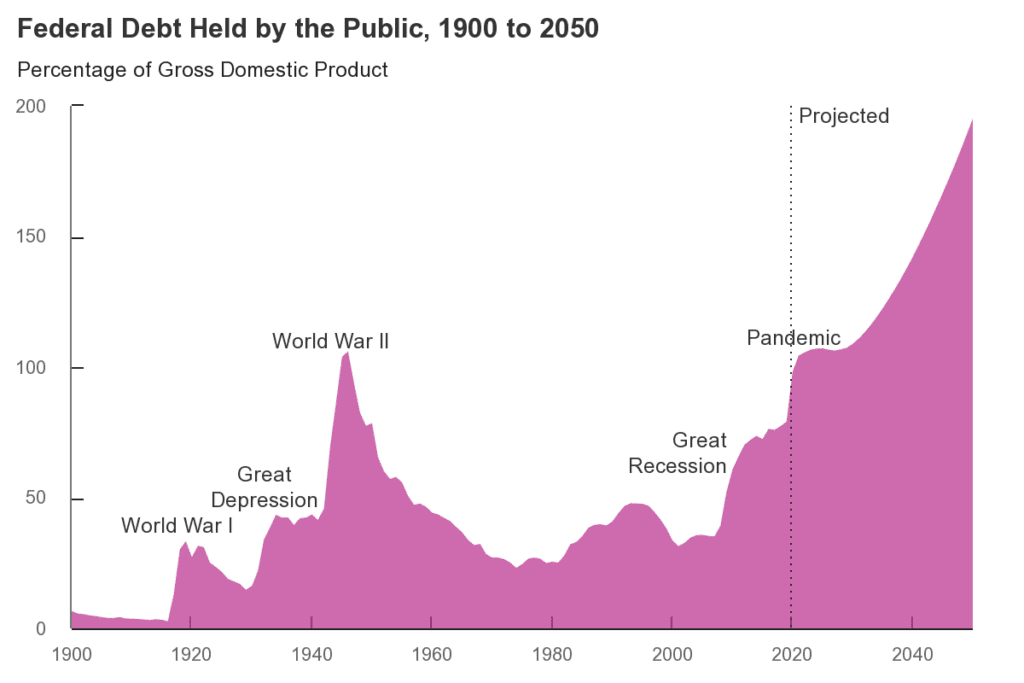

Over the past two decades the United States has rapidly accumulated debt, soaring from $5 trillion in 2000 to over $31 trillion today. The national debt stands at 123 percent of GDP, blowing past our historical record of 112 percent of GDP at the conclusion of the Second World War.

That increase can’t be pinned on any one decision, party, or president. Instead, everything contributed. Existing programs like Social Security and Medicare became more expensive as more people collected benefits and costs crept up. Congress approved more spending, and tax cuts hurt our ability to pay for it all.

None of this is necessarily disastrous. Economists like Paul Krugman argue that “adding to the debt was more than justified” in response to the Great Recession and pandemic. The issue is that US debt is still growing at an unsustainable rate. As interest rates rise and trillion-dollar deficits become the standard, we’re setting ourselves up for trouble.

Over the next decade, we’re projected to spend at least $5.4 trillion on interest payments, which are quickly becoming one of the most expensive items on the federal budget. While interest payments amounted to 1.6 percent of GDP in 2022, the Congressional Budget Office projects they will rise to 7.2 percent of GDP in 2052, more than we currently spend on defense (3.1 percent of GDP) and Social Security (5 percent of GDP).

The bleak outlook also means that welfare programs are barreling toward a funding crisis. Medicare is expected to be insolvent by 2028. The Social Security’s Old-Age, Survivors, and Disability Insurance (OASDI) Trust Fund is projected to be depleted by 2034. While I don’t doubt that Congress will approve a patch for Social Security and Medicare, the path we’re on isn’t sustainable.

Barring a miracle, we’re eventually going to have to raise taxes, cut spending, or both. This creates risks, as changes in welfare policies tend to drive increases in the popularity of extremist candidates, threatening the stability of democracies. The longer we wait, the more significant those policy changes will have to be to create the same effect, and the greater the potential political consequences.

Welfare Cuts Threaten Democracy

In order to close the budget deficit without new taxes, programs that Americans won’t want to see touched would necessarily be reduced, as Philip Bump demonstrated in the Washington Post. Welfare policies could be seriously affected by any attempt to shrink the budget deficit today, and they will certainly be affected if we wait years before taking any action.

Already, House Republicans are weighing cuts to welfare spending. As Jonathan Chait noted in New York Magazine, “A leaked slide from a House Republican meeting showed the party agreeing to cut ‘mandatory spending,’ which means programs like Medicare, Medicaid, Social Security, and anti-poverty programs.” While Kevin McCarthy said Social Security and Medicare cuts are off the table in budget talks, it’s hard to see how they could be forever without an influx of new revenue.

The past two decades in Europe can act as a guide in why this path is so perilous. Opposition to austerity policies was at the core of the rise of Podemos in Spain, the Five Star Movement in Italy, and Syriza in Greece. These populist parties rapidly grew support as the mainstream parties pursued austerity measures.

Importantly, these countries were in economic free fall and the shocks to the welfare state were dramatic. But the US doesn’t have to follow that sort of decline in order to face the consequences. Academic research consistently shows a correlation between cuts to welfare spending and better performance for populist parties, even outside of financial crises.

One study from Harvard looked at 187 elections from 1990 to 2017 across 17 Western European countries. They found that “where countries spend less on income maintenance, and/or have decreased spending from earlier levels, populist vote shares are consistently higher, and the likelihood of supporting populist parties greater.” Significant changes to our budget could giving birth to new populist movements and radical causes, manufacturing a democratic crisis.

The researchers estimate that a “one percentage point [of GDP] decrease in spending on social services leads to a 25% greater likelihood of a voter supporting a populist party.” As another study determined, the effects are “particularly pronounced when the mainstream right and left parties both stand for fiscal restraint.”

The United States is in a tough spot largely of our own making. Ignoring the debt completely is perilous for our democracy, and so is overreacting and slashing the welfare state. Voters won’t accept significant cuts to the programs they depend on without making politicians feel the consequences. This is a situation that demands precision.

While the debt ceiling standoff is ludicrous, there are promising signs that Washington might actually make progress on shrinking our trillion-dollar annual deficit. President Biden and Speaker McCarthy sat down yesterday to discuss the debt and McCarthy told reporters after the talk that he thinks “at the end of the day, we can find common ground.” For the sake of our democracy, we should hope that he’s right.